Commodities & Derivatives Analytics

Commodities and Commitment of Traders (COT) Analytics Platform on Bloomberg BQuant

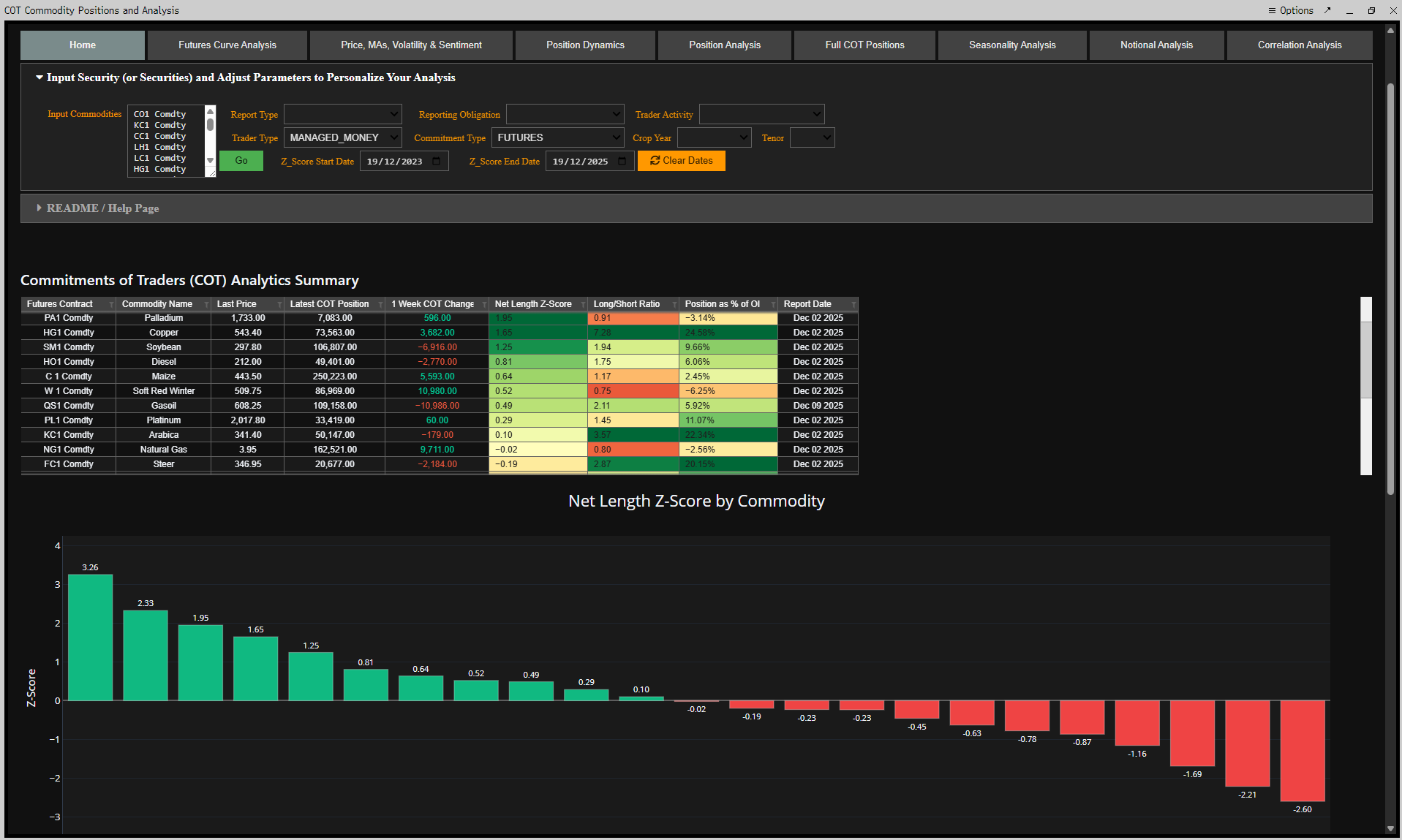

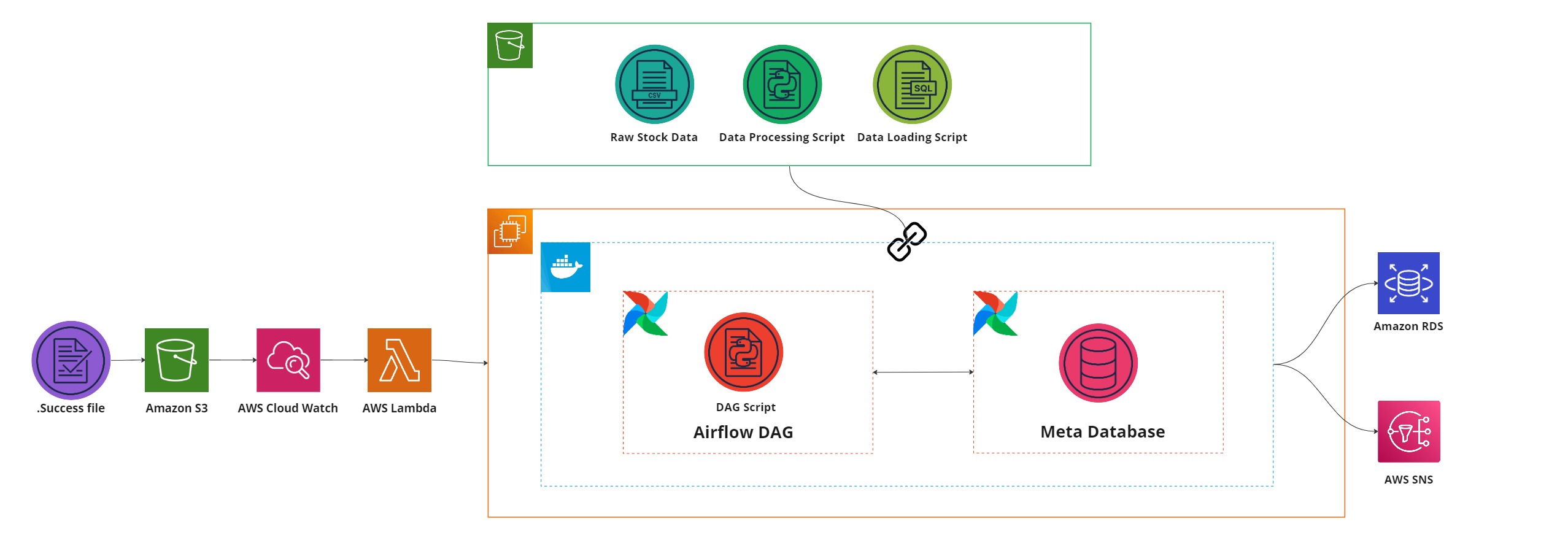

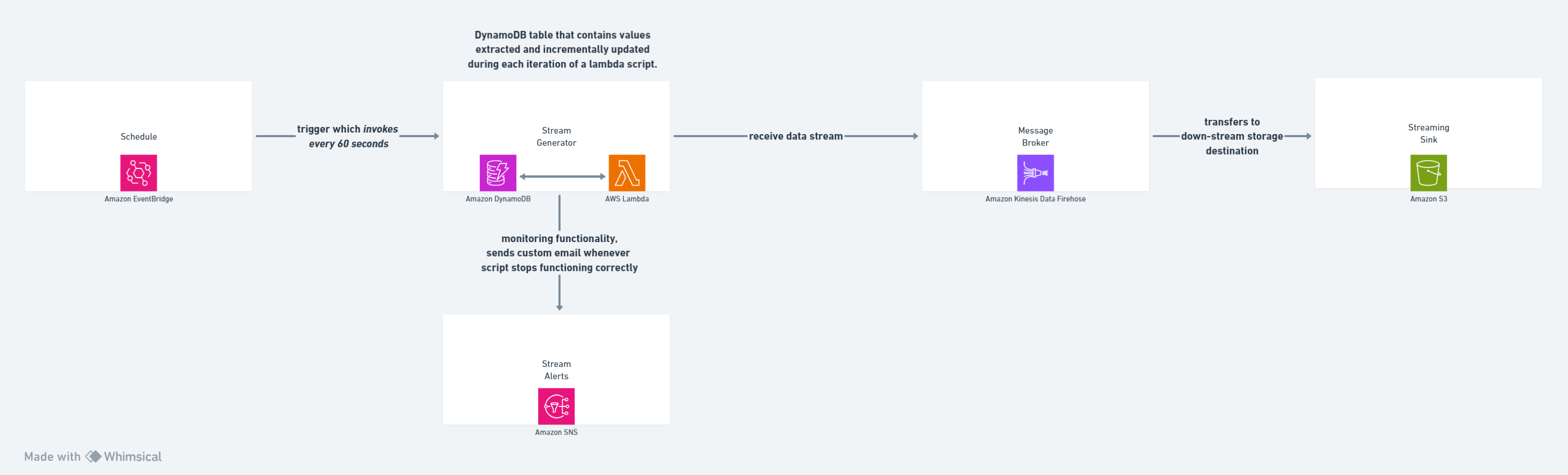

I built a comprehensive multi tab analytical dashboard on Bloomberg's BQuant platform that transforms CFTC Commitments of Traders data into actionable market intelligence for commodity traders and portfolio managers.

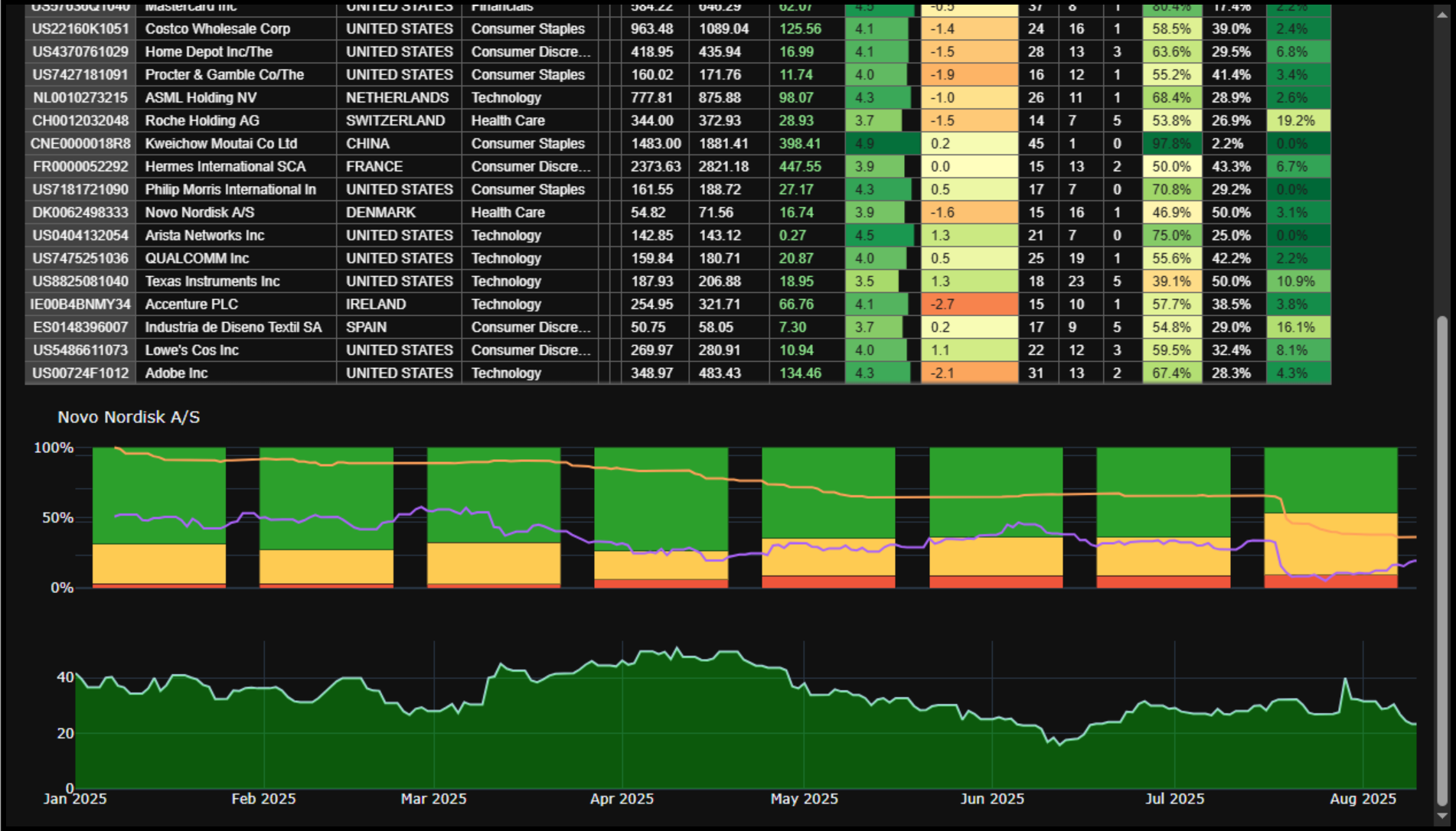

Market Positioning & Sentiment: Multi-commodity COT snapshot with Z-score extremes, long/short ratios, and trader category breakdowns (Commercial, Managed Money, Producers) with color-coded statistical significance.

Futures Curve Analysis: Interactive term structure dashboard featuring normalized forward curves, calendar spreads, roll yield calculations, and automated regime classification (Contango/Backwardation with intensity scoring).

Advanced Analytics: Market regime detection via Hurst exponents, volatility analysis (IV vs RV), position dynamics tracking, 5-year seasonality patterns, cross-commodity correlations, and notional value exposure analysis.